IR Policy

Our Policy

Based on the Iwatani Code of Corporate Ethics, which describes the societal norms on which our business activities are grounded, Iwatani implements the swift, fair, and accurate disclosure of information to all stakeholders, including our shareholders and investors, and promotes constructive dialogue.

Based on the goal of strengthening management transparency and societal trust and enhancing our corporate value through such sustained efforts, we have established this fundamental policy for investor relations.

Disclosure Standards

We undertake timely and appropriate disclosure in compliance with the Financial Instruments and Exchange Act and other applicable laws and regulations, as well as the Timely Disclosure Rules of the Tokyo Stock Exchange.

In addition, we fairly and actively disclose information we deem important in helping stakeholders understand Iwatani, even if such disclosure is not required by laws, regulations, or the Timely Disclosure Rules.

Disclosure Methods

In accordance with the Timely Disclosure Rules, we disclose information subject to the Rules via the Tokyo Stock Exchange’s Timely Disclosure Network (TDnet) system. In addition, Securities Reports and other reports issued pursuant to the Financial Instruments and Exchange Act are disclosed through registration to the Financial Services Agency’s Electronic Disclosure for Investors’ NETwork (EDINET) system.

Additionally, we disclose information we deem important, even if the information is not subject to timely disclosure requirements. We publish this information by posting to the Iwatani website and via other channels.

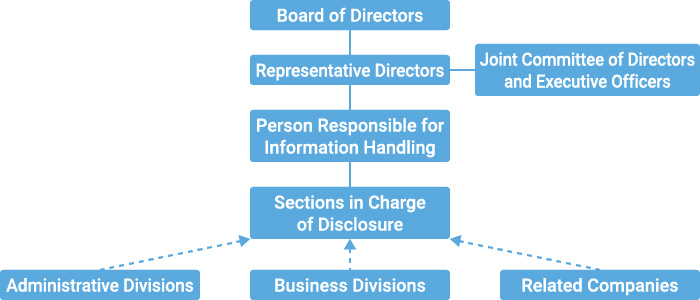

Disclosure Structure

As the sections in charge of disclosure, the Corporate Planning & Coordination Department, Human Resources & General Affairs Department, Public Relations Department, and Accounting Department, led by the person responsible for information handling, all work together to gather important company information and disclose it in a timely and appropriate manner in accordance with the Timely Disclosure Rules.

(i) Information on decisions

Important decisions are made by the Board of Corporate Officers and the Board of Directors. The sections in charge of disclosure, led by the person responsible for information handling, will review in advance whether or not such decisions fall under the category of timely disclosed information. If disclosure is deemed necessary, the sections in charge of disclosure strive to implement such disclosure promptly and appropriately after the decisions are made.

(ii) Information on developments

The sections in charge of disclosure, led by the person responsible for information handling, strive to gather information on important developments from each related section and consider whether it qualifies as information subject to timely disclosure. If disclosure is deemed necessary, the sections in charge of disclosure strive to implement such disclosure promptly and appropriately after obtaining approval of the Representative Director.

(iii) Information concerning financial results

For information concerning financial results, the Accounting Department prepares figures on finances and settlement of accounts and the Human Resources & General Affairs Department and other related sections prepare information on matters, including information concerning corporate governance. Following final approval of settlement of accounts by the Board of Directors, information concerning financial results is disclosed on the same day.

Timely Disclosure Structure

Dialogue with Shareholders and Investors

In our disclosures to shareholders and investors, we strive to promote constructive mutual dialogue through the following structure, in compliance with applicable laws, regulations, and rules.

(i) Person with overall responsibility

The Director responsible for the Corporate Planning & Coordination Department oversees dialogue with shareholders and investors.

(ii) Promotion structure

To ensure the efficacy of dialogue and disclosure, dedicated IR staff are assigned within the Corporate Planning & Coordination Department. We also maintain a structure to enable the effective sharing of information through dynamic joint efforts among administrative sections such as the Human Resources & General Affairs Department, Public Relations Department, and Accounting Department, in addition to the Corporate Planning & Coordination Department, as well as individual business sections.

(iii) Means of dialogue other than individual interviews

Means of dialogue other than individual interviews include quarterly briefings on financial results for analysts and institutional investors as well as facility tours. We strive to enhance the content of these initiatives by ascertaining the views and wishes of shareholders and investors through questionnaires and other means. IR staff in the Corporate Planning & Coordination Department serve as contact points for individual investors, for whom briefings and other activities also are conducted.

(iv) Feedback to core management and the Board of Directors

Information on the views and wishes of shareholders and investors collected through dialogues is shared with the Board of Directors and others through means including reports to management and reporting by the directors responsible.

Management of Insider Information

We strive to control insider information in various ways, including in-house rules on information management and measures to ensure thorough understanding among all our employees. In addition, to prevent information leaks concerning financial results and to ensure equitable behavior, we have multiple staff participate in IR interviews and enjoin them to refrain from answering questions concerning financial results during the “silent period” for IR activities, i.e., from the second business day after the end of each quarter to the date on which financial results for that quarter are announced.