Dividends

Basic Policy on Returns to Shareholders

Iwatani’s basic policy on earnings distribution calls for meeting shareholders expectations by maximizing corporate value in various ways, including investing to support growth strategies while returning earnings to shareholders through stable and uninterrupted dividend payments.

The Medium-Term Management Plan “PLAN27” aims to increase dividends steadily in line with profit growth, targets a payout ratio of 20% or higher in FY2027, which is the final fiscal year of the Plan, based on profit excluding impact of LPG import price fluctuation, and strives for progressive dividend payout without any dividend rollbacks.

The Company believes that by steadily implementing these initiatives and continuing to be “a company needed by society“, we will be able to contribute to the enhancement of the Group’s corporate value as well as the common interests of our shareholders.

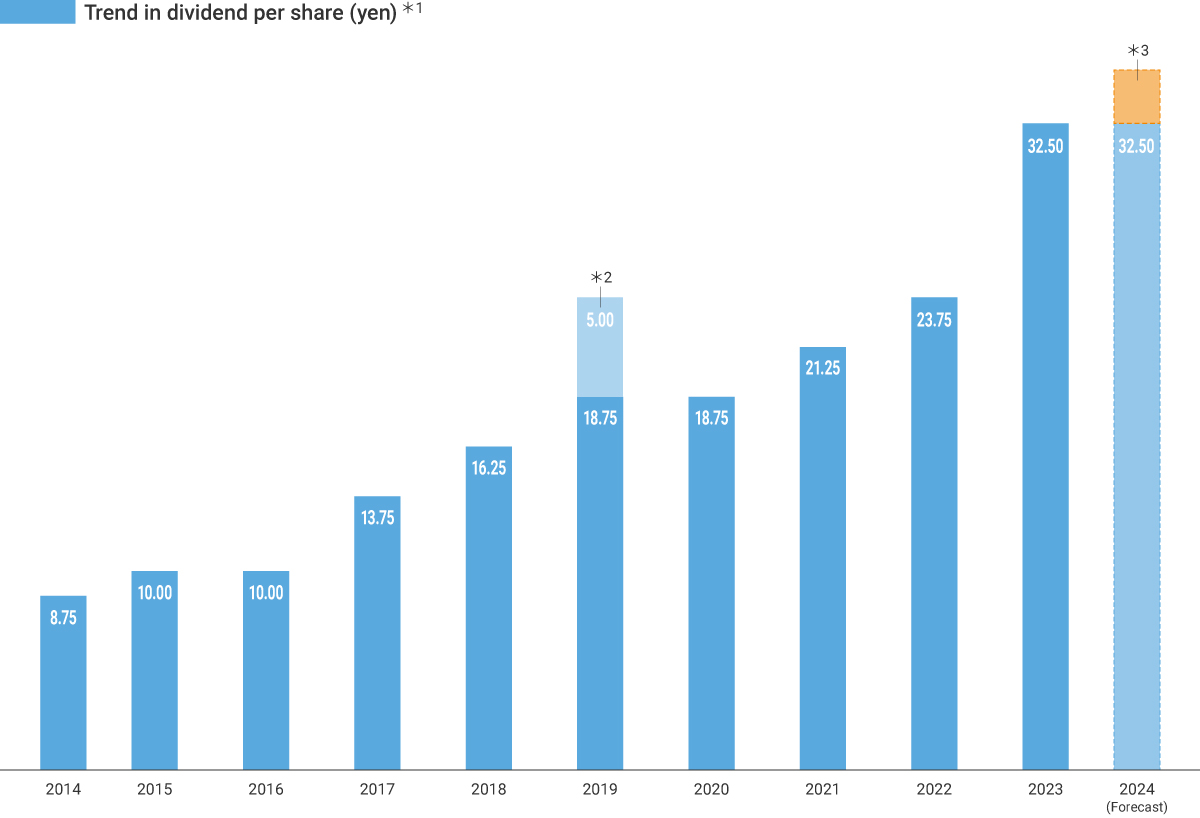

Dividend Trend

- ※ On October 1, 2024, the Company conducted a four-for-one stock split of its common stock to shareholders.

All dividends shown are after taking into account - ※ The Company plan to pay the interim dividend from the fiscal year of March 31, 2026.